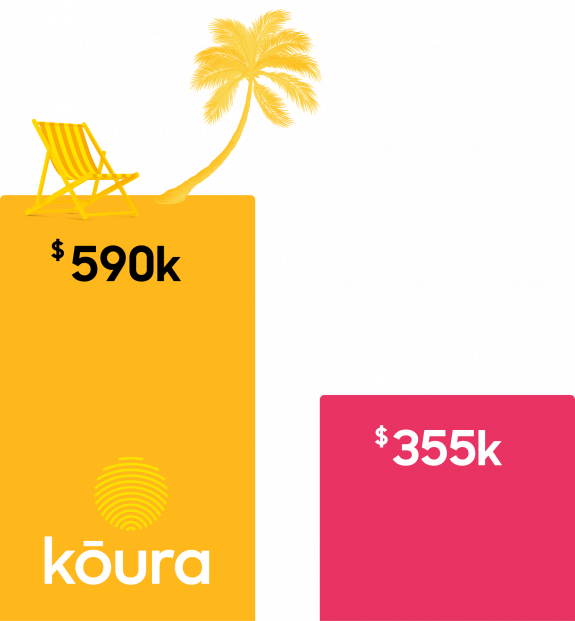

HELPING KIWIS HAVE BETTER RETIREMENTS

We want the best for all Kiwis

Proven Strategy

We invest broadly across industries, markets and countries to diversify your investment and reduce risk.

Sustainable Funds

We all want to make sure we build a future that we can be proud of - we invest with our planet and our people as a priority

Kiwi Owned

75% of KiwiSaver funds are overseas companies. NZ owned funds have outperformed foreign funds.