GameStop: What happened and what can we learn from it

The limelight of the share market in January 2021 was the astronomical rise of GameStop shares, fuelled by retail investors from the Reddit forum 'wallstreetbets'. In this short article, we explain what happened and three key investment lessons that any aspiring investor should take out of the event.

What is GameStop?

GameStop is a brick-and-mortar retailer predominantly selling video games, consumer electronics and gaming merchandise. New Zealand readers might be more familiar with their NZ subsidiary, EB Games.

Over the past ten years, gaming has shifted toward online channels due to digitalisation and COVID-19 has only accelerated that trend, leading to significant fears around the GameStop business model's longevity. Many investors believe that GameStop is heading in the same direction as Blockbuster, the once large and popular global DVD rental chain that filed for bankruptcy in 2009.

What actually happened?

When investors believe a share price will fall, they "short" a stock. Effectively this means they borrow stock today to sell on the market, with the expectation they will be able to purchase the shares on the market at a lower price in the future to repay the "borrowed" stock. A more eloquent explanation of short selling is here.

GameStop was the most shorted stock in the US stock market, with 140% of shares shorted. Members of the Reddit forum 'wallstreetbets' jumped on this. They decided to take advantage of this situation, effectively creating a short squeeze and in the process giving Wall Street a very bloody nose.

A short squeeze occurs when investors who short a stock need to buy additional shares to prevent further losses. As they purchase shares, this can cause the share price to go up due to a lack of shares available to buy on the market.

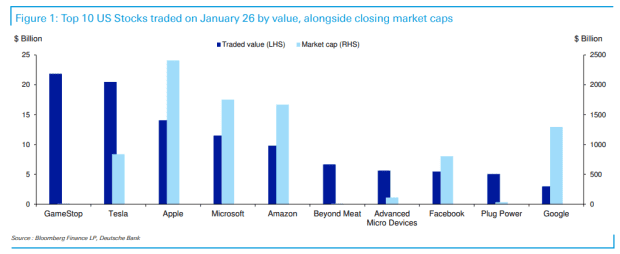

By mid-January, news of the Reddit forum movement had gained momentum, pushing the shares from US$39 to a high of US$483 over five days. On Friday, January 26, GameStop was the number 1 traded stock in the US, an incredible feat for such a small company.

The volume of shares purchased far exceeded the shares available, which pushed the share price to such a high. Ultimately, it was simple supply and demand economics; the demand for shares could not be met by the market, so the share price rose.

Chart 1: GameStop's volume traded and share price

What was the reaction?

The outcry from Wall Street was huge. They could not believe that they had been beaten at their own game by "unsophisticated" retail investors. Hedge Funds and market commentators started to throw out words such as "collusion" and "market manipulation" two highly illegal activities.

During this time, US discount broker Robinhood made the controversial move to limit GameStop shares' purchase. This has only compounded retail investors' view that the market is set up to benefit Wall Street and disadvantage retail investors. Many believe RobinHood was instructed to limit the trading to help protect hedge funds - their critical business partners.

The act of limiting retail purchasing of the shares took the demand out of the market, and the shares immediately fell, closing at 44% below the previous day. Over the subsequent three days, the shares fell from their Friday high of $413 back to $90, a fall of 78%.

The reaction from politicians has also been swift and loud. Two avowed enemies, Ted Cruz (a Trump-supporting Republican Senator) and Alexandria Ocasio-Cortez (a very left-leaning Democratic Congress Woman) have come out saying regulation needs to change to stop this from happening again.

What's next?

In our view, nothing is likely to change here. This was a well-executed short squeeze that was amplified by the power of social media. The Reddit posters' behaviour was no different from what activist hedge funds have been doing for years. However, this was far more successful due to the 6 million members of wallstreetbets jumping on board and supporting this view.

This shows social media's power on the markets and their ability to get people to act and act exceptionally quickly. Several institutions already monitor social media for critical trends, though this episode will only accelerate the use of social media as an important investment research tool. Social media has introduced a new element that investors will need to consider when taking positions or monitoring their positions.

In our view, short selling is an essential tool allowing people to hedge their market positions. There are unlikely to be any changes to how investors use short selling or the regulations surrounding them. Though moving forward, investors will be very wary of the underlying liquidity when entering into a short position.

Key investment lessons

Don't invest when you are experiencing FOMO (fear of missing out)

While the feeling of FOMO can be felt when not making this guest list to a party or scrolling down social media and seeing others living their best life, the same feeling of FOMO also applies to investing. The fear of missing out on the next hot stock may cause an investor to buy a stock near the top, only for them to end up being the 'bag holder'. In most cases, by the time you hear others talking about the next big thing, it's usually too late.

For most investors, investing in GameStop was not sustainable in the long term, as GameStop's price did not reflect its fundamentals. Investing in the hype often leads to losses; any investors who purchased during this period are likely to suffer significant losses.

Investors want a purpose bigger than making money when investing

During the GameStop phenomenon, we saw that across the social media chatter and Reddit forums, there were traders who were buying GameStop shares to fight back against the injustices of hedge funds and institutional investors (the 'big guys'), who don't have the best reputation for transparency and a tainted history of market manipulation. While there was an element of making a profit from trading the stock, there were some traders who were unconcerned regardless of whether they made money or not.

The future of investing is investing in what you care about. It's important to us that we demonstrate our principals in where we invest our money. That's why Kōura invests transparently according to a set of environmental social and governance principles wherever possible.

Investing in individual companies can be risky

While several traders have made a life-changing amount of money on GameStop, chances are there will be tens of thousands of traders losing money. GameStop has not fundamentally changed from a few months ago; they are still facing the same structural problems before the rally, yet their share price has increased many times over. Therefore, buying the stock right now doesn't make sense from a long-term perspective, but rather it is a gamble on short term price movements. No one can predict where the stock price will go in the short term, but in the long-term share, prices will correct itself.

We hope that investors who have lost money could afford that loss, and that has not put their financial future at risk. The first rule of investing is to have adequate diversification. You need to ensure you have a very well-diversified portfolio. For smaller investors, often the easiest way to do that is through a managed fund. A managed fund will pool your investment with other investors to benefit from the scale that it creates, and together you will be able to have a low-cost portfolio across a wide range of securities. This means you are never too exposed to the success or otherwise of a single company.