Chasing KiwiSaver fund performance is a bad idea

A common disclaimer you will find in finance is “past performance is no indication of future performance.”

It seems like a clear enough warning. However, when you pair this information with social media posts sharing a funds’ great performance in a year or advertisements that focus on performance, it is easy to see why investors continue to practice the one strategy that does not work consistently – chasing performance and fees.

Many investors make the mistake of thinking that a fund or KiwiSaver scheme with a great track record over the last year, 3 years, or 5 years, is a “great scheme”. However, research shows that KiwiSaver fund performance chasing is likely to reduce your returns and that the risk of underperformance is highest immediately after a period of consistent over performance.

Research out of the US shows that a top fund in any given 5 year period, is extremely unlikely to be a top-quartile fund in the following period. The reasoning for this is clear; an investment manager has chosen a successful strategy, though it is unlikely that investment strategy will work in a different market cycle, so the manager needs to pivot and start again.

This is also clear in the New Zealand context. We have done some work looking at the historical returns of growth (or growth equivalent funds) in the New Zealand market. We ranked KiwiSaver funds based on their 3-year returns in 2014, and then again looked at their performance at the end of 2019. The evidence is very consistent with what we have seen internationally; being a top performer historically does not mean that you will be a top performer moving forward.

| 3 yr Returns: 2014 | 2014 Ranking | 3 yr Returns: 2019 | 2019 Ranking | Change in Ranking | |

| Milford Active Growth | 20.4% | 1 | 12.2% | 3 | -2 |

| KiwiWealth | 18.8% | 2 | 10.6% | 10 | -8 |

| ANZ Growth | 17.1% | 3 | 11.3% | 5 | -2 |

| AON Russell Lifepoints Growth | 15.9% | 4 | 11.1% | 7 | -3 |

| Fisher Funds | 14.1% | 5 | 12.3% | 2 | +3 |

| Westpac growth | 13.8% | 6 | 10.9% | 9 | -3 |

| ASB Growth | 13.5% | 7 | 11.4% | 4 | +4 |

| Fisher Two Growth | 13.4% | 8 | 10.6% | 10 | -3 |

| Booster High Growth | 12.3% | 9 | 11.2% | 6 | +3 |

| AMP Balanced Growth | 12.3% | 10 | 10.3% | 11 | -1 |

| Generate Growth | n/a | 14.2% | 1 | ||

| BNZ Growth | n/a | 11.0% | 8 |

Source: Morningstar Quarterly Reports Dec 2014 & Dec 2019

This shows us that swapping KiwiSaver providers on the back of three or five-year performance numbers alone may be a poor decision. Historical returns not only give you very little information about future returns, but they can also increase the odds that you will make a bad decision because if you switch to a high performing fund, it is statistically doubtful they will continue to be a high performing fund.

The chasing returns strategy.

Taking this to the next level, one of the worst things that investors can do is chase fund manager returns. Investors often fall into the trap of pulling money out of medium performing funds to invest in the top-performing funds. Unfortunately given the short term nature of fund outperformance (i.e. they will only outperform for a short period of time) by the time they choose that fund, it is too late. That fund has now turned back into an average performer.

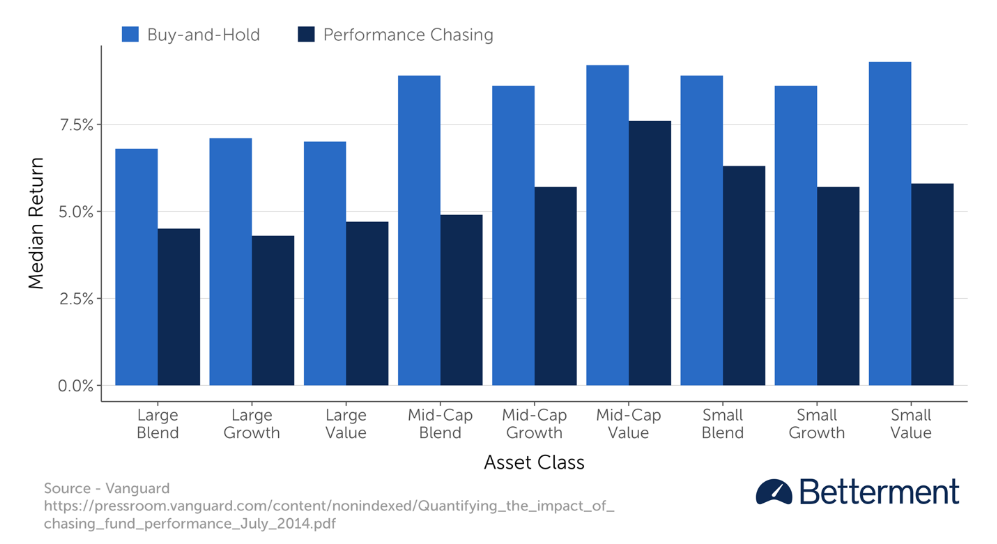

Research from Vanguard has managed to quantify this; it shows that the returns achieved by investing in the best fund in each asset class, compared to a buy-and-hold strategy. Performance chasing—picking investment based on recent performance—produced worse returns of about -2% to -3.5%.

So what should you do?

We're no saying that you should stick with an underperforming fund. If you have a poor performing fund, you need to look at it and assess whether it is time to move. Because unfortunately, some funds do continually underperform.

So, if you shouldn't pick a scheme based on past KiwiSaver performance alone, then what should you do? First of all, before you think about the type of fund, you really need to think hard about what type of fund you invest in, that will be the biggest driver of returns, over and above underlying fund manager decision.

After you've picked your type of fund, you need to choose the fund manager, in choosing your fund manager, you should look at the following factors:

- The people involved in the scheme - are they experienced and did you trust their decision-making ability.

- The fees - remember lower fees will generally lead to higher returns for you in the long term.

- The sustainability level of the fund - you want to make sure that your fund manager is investing in investments that you actually want to own

- The underlying asset allocation (split of growth vs income assets) - remember not all growth or conservative funds are the same.

- The historical performance of the scheme

At Kōura, we firmly believe that combining great asset allocation (the proportion of growth and income assets your KiwiSaver fund is invested in) with passive management will deliver the best outcome for investors. Passive management means investing in the market rather than trying to beat the market. This has become the most popular form of investing in the US as a result of its proven ability to beat the market.

.png)