What does Coronavirus mean for my KiwiSaver balance

Many KiwiSaver funds have fallen over 20% in the past month as the Coronavirus has shaken markets.

This has been an extreme period of volatility in the markets. And the net result is your hard-earned KiwiSaver dollars are less today than they were a few months ago. KiwiSaver schemes call centres are overloaded with people trying to figure out exactly what they should do right now. In this simple post, we are trying to answer your key questions.

What is going to happen from here?

Unfortunately, we do not have a crystal ball and do not know what will happen from here. The only thing that we can do is look at history to understand how markets performed in previous crises. Set out in the charts below you can see how markets have performed in previous crises.

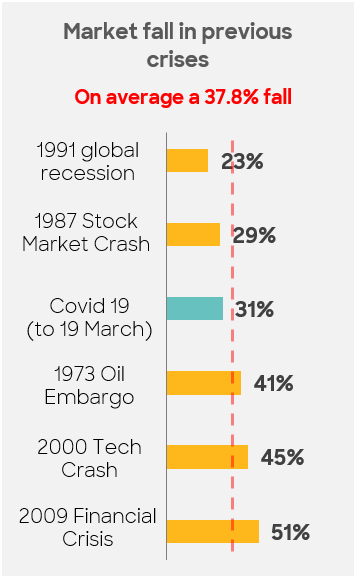

Market performance in previous downturns

Notes:

- 1973 Oil Embargo, 1991 Global Recession and 1987 Stock Market Crash fall calculated based on US S&P500 index adjusted for dividends

- 2001 Tech Crash and 2009 Financial Crisis calculated on MSCI World Total Return Index

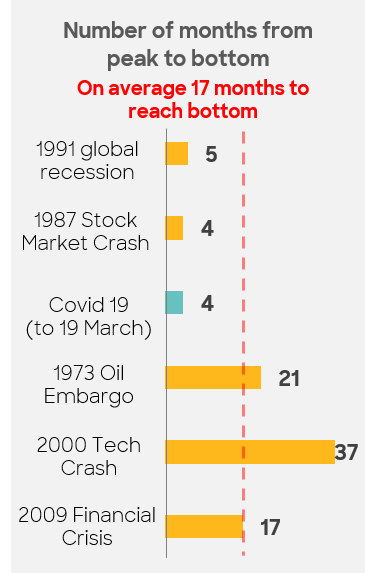

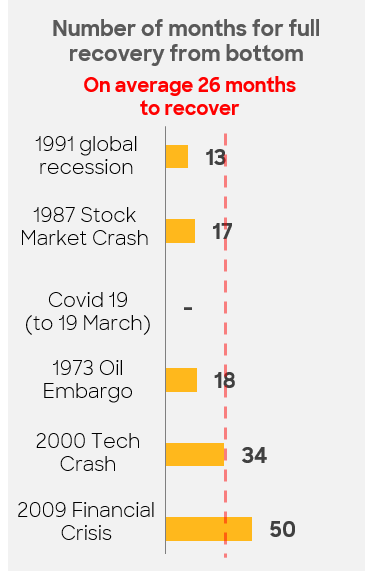

This historical analysis gives us some useful parameters around what might happen moving forward:

- The average fall from peak to bottom was 37.8% with the largest fall being a 51% fall through the 2008 – 2009 Global Financial Crisis

- On average, it took 17 months for markets to reach their bottom, with the longest peak to trough period being the 2001 technology meltdown at 37 months. The shortest peak to trough was the 1987 crash which only took 4 months. It is important to note the technology meltdown coincided with the September 2001 attacks which tipped the US into recession

- It took on average 3.5 years for markets to return to their previous peaks, with the shortest period being 17 months following the 87 crash through to the longest recovery of 50 months (just over 4 years) from the Global Financial Crisis

It is important to point out that the Global Financial Crisis was the worst event we reviewed, though this was also the worst global depression since the 1930s. Global economic activity contracted further and at a faster rate than at any time since the 1930s, so, therefore, we think that is a good barometer for a worst-case scenario.

Whilst each and every scenario is different, understanding what has happened in the past sets us up with a good benchmark around how it might look this time.

So what should I do

For most people the answer is do nothing, the majority of the damage is already done, and by trying to make changes now, you are more likely to miss out on the recovery. The only people that should be contemplating moving to a lower risk option right now are the people that need their money in the next 12 to 24 months (probably to buy a house). It is important to point out here that even if you are approaching retirement, you do not necessarily need your money in the short term. You should be planning on

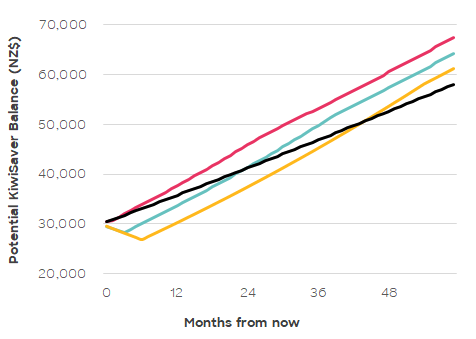

To emphasise the impact of different strategies on KiwiSaver funds, we have mapped out four different scenarios, the first 3 scenarios assume an investor remains invested in a growth fund through the crisis. The final scenario assumes a switch to a conservative fund now:

- We have reached the bottom – in this scenario, we assume that markets are already at the bottom and the recovery starts now. Inline with historical average it will take 26 months for markets to fully recover

- We have further to fall – under this scenario we show the impact of a further 10% reduction in global markets, moving this crisis in line with the 1975 oil crisis. We assume it takes 36 months for markets to recover from this low level

- Global financial crisis repeats itself – under this scenario we assume markets have a further 20% to fall and then take 50 months to recover from their lows. This is a repeat of what happened in 2008/2009.

- Switch to a conservative option – finally, we show what will happen if you switch to a conservative fund right now

KiwiSaver balance outcomes with different scenarios

Assumptions:

- Assumes Investor earns $80,000, has a starting balance of $30,000 and contributes 3%

- Fixed income (and conservative fund) assumed to earn 2.5% through downturn and recovery

- Growth fund assumes to earn 4.5% from time markets have recovered

As you can see, moving to a conservative option now will give you the worst outcome over the longer term. You might think that you can move once markets have recovered, though we will cover that below.

From the chart, you can see that the only person better off in a conservative fund (black line) is someone that needs to withdraw their money in the next 1-2 years. Anyone with a risk horizon longer than this is better off remaining in the growth option.

Why shouldn't I move to conservative now and then go back to growth when the markets start to recover?

There are two very simple reasons why you shouldn’t back yourself to time the markets and pull the recovery out now:

1. It is very difficult to time the markets, and you are likely to miss out on a part of the recovery

People have forever tried to pick the markets, and unfortunately, all of the research shows that most people fail. Research shows that everyday investors generally perform 3-4% worse than the markets as a result of trying to time the markets (selling in a falling market and buying in a rising market).

Markets over the past month have been extremely volatile. We have had 6 positive trading days and 9 negative trading days with 5 days of movement greater than 5%. Each positive day is indicative that traders believe we have reached the bottom, so can be read as a sign that the markets might have recovered.

Potentially you would look for evidence of a "sustained recovery". Unfortunately, this is harder than it sounds due to the speed with which markets can move. Markets never behave in the nice straight lines as we have shown in the charts above.

In March 2009, markets moved very quickly once Governments delivered a clear plan to bail out the banks and provide fiscal stimulus. The markets rose 10% in the first week from their lows and by the end of the second week were up 18%. For investors who were waiting for evidence of a sustained recovery, they would have missed out on this rally and therefore missed out on the first 18% of the recovery. Given the size of the market rallies we are currently seeing, we would expect similar behaviour in this crisis

2. You are still contributing at the bottom

Most KiwiSaver members contribute every month, this means that you will continue to contribute at the lowest points, and those contributions will grow with the full recovery. This is called “dollar-cost averaging” your average investment entry point falls as you continue to through the downturn.

So, our very strong advice does not try and time the market as very few people succeed here. Develop your long term investment plan and stick to it!

Will it help if I change scheme provider

Whilst you might be very frustrated and angry at your current KiwiSaver provider, all KiwiSaver providers are exposed to the markets. Some will be better and worse than others, but it is too early to judge your fund managers performance.

Our suggestion is that once things calm down, you take a look and assess your KiwiSaver providers' overall performance through this challenging period, some of the criteria you might want to use to judge your KiwiSaver provider are:

- How helpful was your KiwiSaver provider to you - were they proactive in their communication and were they available you when you wanted to talk to them

- Did your KiwiSaver provider give you the right information to ensure you were in the right type of fund before the downturn hit, were you exposed to too much risk?

- And finally, how did your KiwiSaver fund perform through this period of volatility - have they performed materially worse than everyone else?

It will be easier to think through these questions in the calm light once we have confidence in where we are going. Rather than trying to do this now.

Want to learn more

Controlling your personal instincts is one of the hardest things for investors and KiwiSavers, particularly at times like these. In this post here we talk through the costs of not ignoring your personal instincts and the importance of sticking to a personal plan.

Understanding your risk profile is critical at times like this. Your KiwiSaver portfolio needs to match your risk profile, we have seen lots of people that are no longer able to purchase their first homes because they were in a growth fund when they should have been in a conservative fund. They didn't understand their risk profile. In this post, we talk about the importance of understanding risk appetite.

About Kōura

Kōura is unique as it is the only KiwiSaver scheme that uses a digital adviser to build every customer a personalised KiwiSaver portfolio. We assess each person's risk appetite and objective (retirement vs. first home) and build a portfolio to suit that person. We strike a fine balance, we strive to keep you safe against downside risks while also making sure you achieve the best possible KiwiSaver balance. You can find out more about Kōura here.

We hope that you have found this helpful if you have any questions, or would like to discuss any points in this blog, then please don’t hesitate to send us an email at [email protected]