What does risk really mean for your KiwiSaver investment?

What's your risk appetite? How do you make the right choice and how will it impact your KiwiSaver balance?

What do we mean by ‘risk’?

When you’re asked about your risk appetite, you’re basically being asked to assess your willingness to withstand the ups and downs of the market - investing can be a nervy exercise. In finance, higher risk generally means a higher return in the longer term. But the trade-off is higher volatility (lots of ups and downs) along the way. Markets are cyclical and will always go up and down. If you want the higher returns, you need to be prepared to ride the ups and downs, you need to decide whether you are comfortable with these ups and downs.

People often think that taking on extra risk means you’re putting yourself in the danger zone of losing all your money. But, so long as you have a properly diversified portfolio (your money is invested across a wide range of investments), this shouldn’t be the case at all.

How does risk apply to the different assets?

The two assets that we typically talk about in terms of investing are:

- Growth assets: These assets target capital growth and include shares, property and infrastructure. These assets will deliver higher growth, though will have lots of ups and downs

- Income assets: These assets target ongoing income distribution and include fixed income, cash and term deposits. These assets typically have fewer ups and downs, though typically will have lower returns.

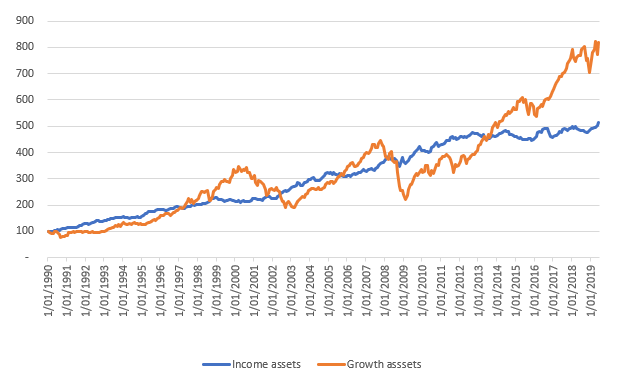

In the chart below you can see the difference in the kinds of volatility and returns you can expect when investing in growth vs income assets.

Source: Growth Assets: MSCI ACWI Index, Total Return Index | Income Assets: Bloomberg Barclays Global Composite Bond Index, Total Return Index

As you can see, if you’d invested $100 into this set of growth assets in January 1990, you’d now have over $800. If you’d invested that same $100 into a set of income assets, you’d now have around $500. This is a significant difference, especially when that $100 investment is multiplied many times over. But you can also see the growth assets show significantly higher volatility (ups and downs) than the income assets, which are lower risk and usually experience lower volatility.

Dollar-cost averaging is a very popular finance theory, and we think particularly important for KiwiSaver. Under this theory, if investors are continuing to place a fixed amount into an investment, they should not be too worried about the intra-period volatility. They will be investing at the bottom of the market, as well as the peak of the market, so should only be concerned about the general market direction. KiwiSaver is a long term investment where investors continue to contribute, so we think that dollar-cost averaging is very relevant to KiwiSaver.

Through this period (1990-2018), there have also been two significant market downturns, so it’s interesting to see how the growth portfolio performed during these periods:

|

Market downturns |

Peak to trough change |

Time to recovery |

|

Dot Com Bubble (2000-2003) |

41% downturn |

7 years |

|

Global Financial Crisis (2007- 2009) |

51% downturn |

3.1 years |

If you look further back, you’ll see similar trends – significant market dips followed by a recovery over a specific period of time.

What does this mean for your KiwiSaver fund?

Most KiwiSaver funds are well-diversified groupings of liquid global assets, so the risk of losing your money over a long period of time is extremely low. Coming back to assessing your 'risk appetite' then, here are the two questions you should ask yourself:

1. Are you willing to remain invested through the ups and downs?

The global share market is cyclical and there will always be ups and downs, some bigger than others. The worst thing that you can do for your KiwiSaver account is to switch to a different strategy at the bottom of the market. That way you will lock in your losses and won’t earn the investment gains when the markets bounce back again. If you’re willing to hold your investment through both the upturns and downturns of a cycle, and you have enough time until you retire to do so, you’ll be better off invested in riskier assets. If you think you’re likely to sell your assets in a market downturn, locking in your losses in the process, you’re better off in a lower risk set of funds.

2. When will you be accessing your money?

Some people don’t have a choice about keeping their money invested or not. If you’re getting close to retirement or you expect to buy your first home in the near future, then you should be looking to invest in lower-risk funds so you don’t need to risk having to pull out your funds during a market downturn.

The Kōura difference

At Kōura, we understand that this retirement investment business is complicated and not that intuitive. In finance speak, the risk does not really mean risk (for a properly diversified portfolio), it means volatility. That’s why we don’t ask you what your risk appetite is. We ask you a set of targeted questions to help us understand your risk profile. Our questions are designed to uncover your objectives, how you’ll use the funds and how you’re likely to react in a market downturn. And these all help us to assess your risk appetite.

Check your risk profile now