Join thousands of Kiwis

>$400m

Funds under management

8,600

Members

4.0★

Trustpilot Rating

Navigating life's financial milestones

Get personalised insights to help you make better KiwiSaver decisions

-

Getting Started

-

Saving for a first home

-

Building my wealth

-

Investing for my kids

-

Approaching Retirement

Setting up your KiwiSaver Plan for the first time

You’ve never had KiwiSaver before, you don’t know much about it, but you think it could be important. You’re right. KiwiSaver is your financial superpower. Done properly, it can help you into your first home and set you up for the retirement of your dreams

KiwiSaver is the most important tool to get you into your first home

You have a KiwiSaver plan, you know it’s important, but you need to figure out how it can help you save for your first home? Kōura has your back. Done properly, your KiwiSaver investment can help you grow your deposit faster.

Using your KiwiSaver investment to build your wealth and secure your tomorrow

Want to figure out how to make the most out of your KiwiSaver investment? KiwiSaver is your financial super power. If done properly, it can set you up for the retirement of your dreams.

Give your kids a headstart with a KiwiSaver plan and secure their tomorrow

You have kids, maybe they’ve started their first job, or you want to start putting a little bit aside for them, you know KiwiSaver is important and you want giveyour kids a jumpstart? KiwiSaver is your simplest way to get started. Done properly, you can set your kids up for financial success

Using your KiwiSaver investment to secure the retirement of your dreams

You’ve been steadily building your KiwiSaver investment over the years, now you’re looking at the end game. The right fund type makes all the difference in this final stretch.

Hear what Kiwis have to say about Kōura

★★★★★

"KiwiSaver shouldn't be frightening or complicated. Kōura makes it simple, giving you the confidence that your KiwiSaver is working harder for you"

★★★★★

"I chose Kōura because I really wanted to make a change and make a change long term. Picking the right provider was important for my retirement and the future I want to have."

★★★★★

"It’s a personalised business so it gives me the comfort that my money is safe."

Why Kiwis choose Kōura

We level the playing field

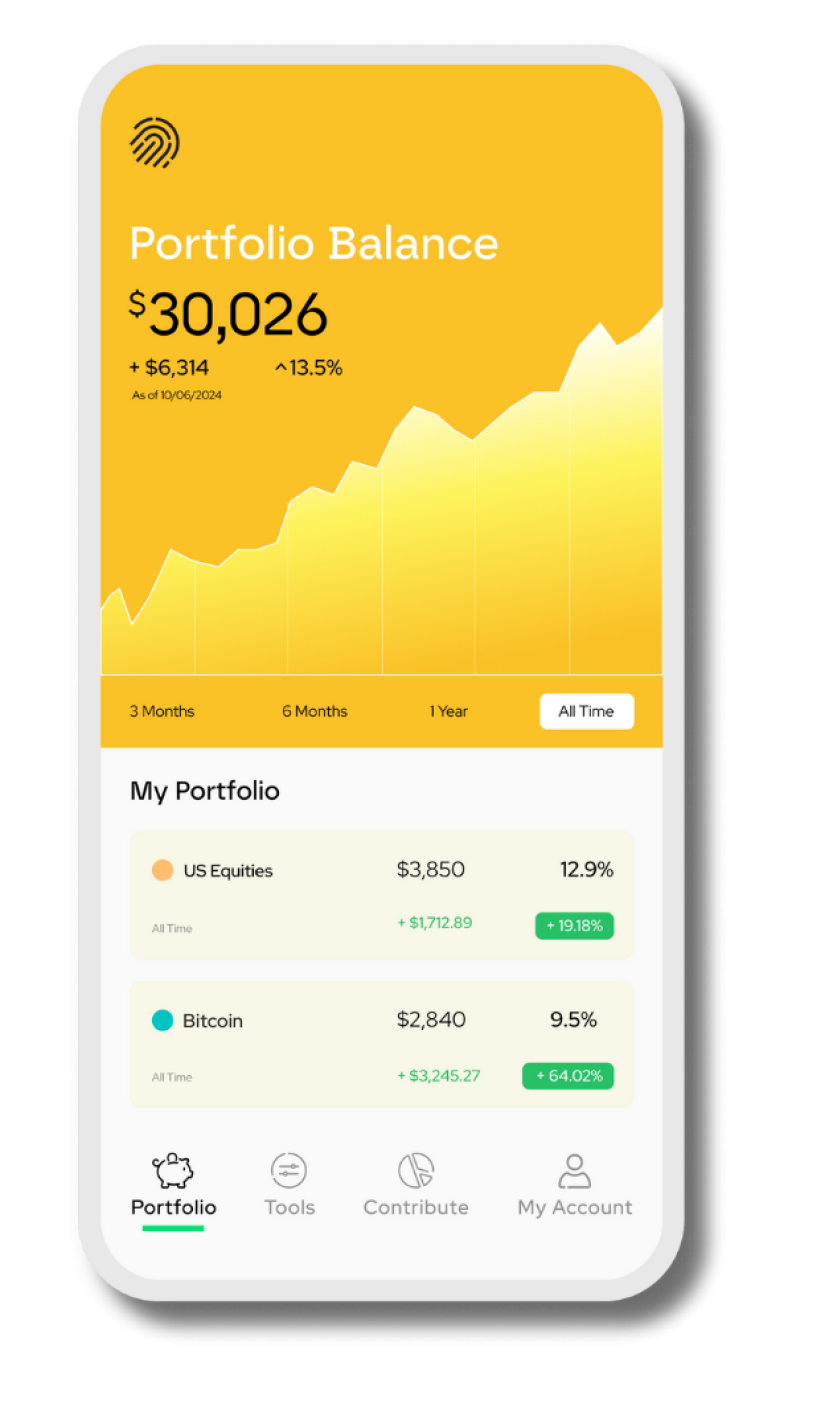

The tools and strategies you need to make the most out of your KiwiSaver plan.

We've got your back

Digital tools when you want them, human guidance when you need it. Help on your terms.

You're in charge

Ten flexible fund options let you build a portfolio that suits you - your choice.